Brazil Carry Trade: How LatAm FX is Reshuffling After BOJ's Wake-Up Call

If you still remember January 24th, it wasn’t just another headline. We weren’t talking about something cliché like Trump storming back into office—but something arguably scarier, unfolding quietly on the other side of the Pacific. It was pure chaos across trading floors as the Bank of Japan (BoJ) finally twitched after decades of rock-bottom and even negative rates. For the first time in a generation, the ultimate anchor of cheap funding looked like it might be stepping onto a tightening path.

"Maybe it was too early to call it a full regime shift. But one thing was certain: every trader running a carry book, popping melatonin to sleep that night, knew deep down this was the risk they feared most," said an FX industry professional at Morgan Stanley in our phone interview, speaking on condition of anonymity.

When the BoJ’s shock Yield Curve Control (YCC) tweak in January blew up the JPY-funded carry trade, it was a brutal reminder: easy funding ain't forever. Traders who had been milking cheap yen for high-yield EMFX found themselves wrong-footed, scrambling for exits. With yen carry no longer a free lunch and USTs offering only "meh" returns, the hunt for the next sweet spot is wide open.

Cue LatAm. Central banks across the region hiked early and hard in 2021–2022, leaving behind some of the world's fattest real yield spreads. But by 2023, most of the region flipped into easing. The Bank of Mexico (Banxico) tapped out at 11.25% and has since slashed rates to 9% by March 2025. Chile, Colombia, Peru—all easing. Meanwhile, Banco Central do Brasil (BCB) refused to blink. After a brief 2023–2024 soft patch, Brazil flipped back into a hiking cycle in early 2025, with rates snapping back from 10.75% to near 14%. In a LatAm landscape that's mostly softening, BRL still stands tall—and misunderstood.

Brazil’s “REAL” Story: Between Noise and Carry

Brazil’s been flying under the radar, but don’t sleep on it. Despite Trump lobbying 10% tariffs Brazil’s way, president Lula kept it cool, opting for talks over tantrums. As Bloomberg’s Maria Elena Vizcaino noted, that steady hand helped keep Brazil’s macro story intact. Meanwhile, tight backchannels with Xi through the BRICS setup gave Brazil another buffer against global volatility. In a world chasing stability, boring suddenly looks beautiful.

Under the hood, Brazil's macro is heating up again. After torching rates up to 13.75% in 2022 and easing steadily into 2024, Banco Central do Brasil (BCB) hit pause, then flipped hard back to hikes in early 2025. From a floor around 10.75%, BCB has jacked rates back to nearly 14% in just a few moves. Inflation expectations remain sticky, and BCB isn’t playing games.

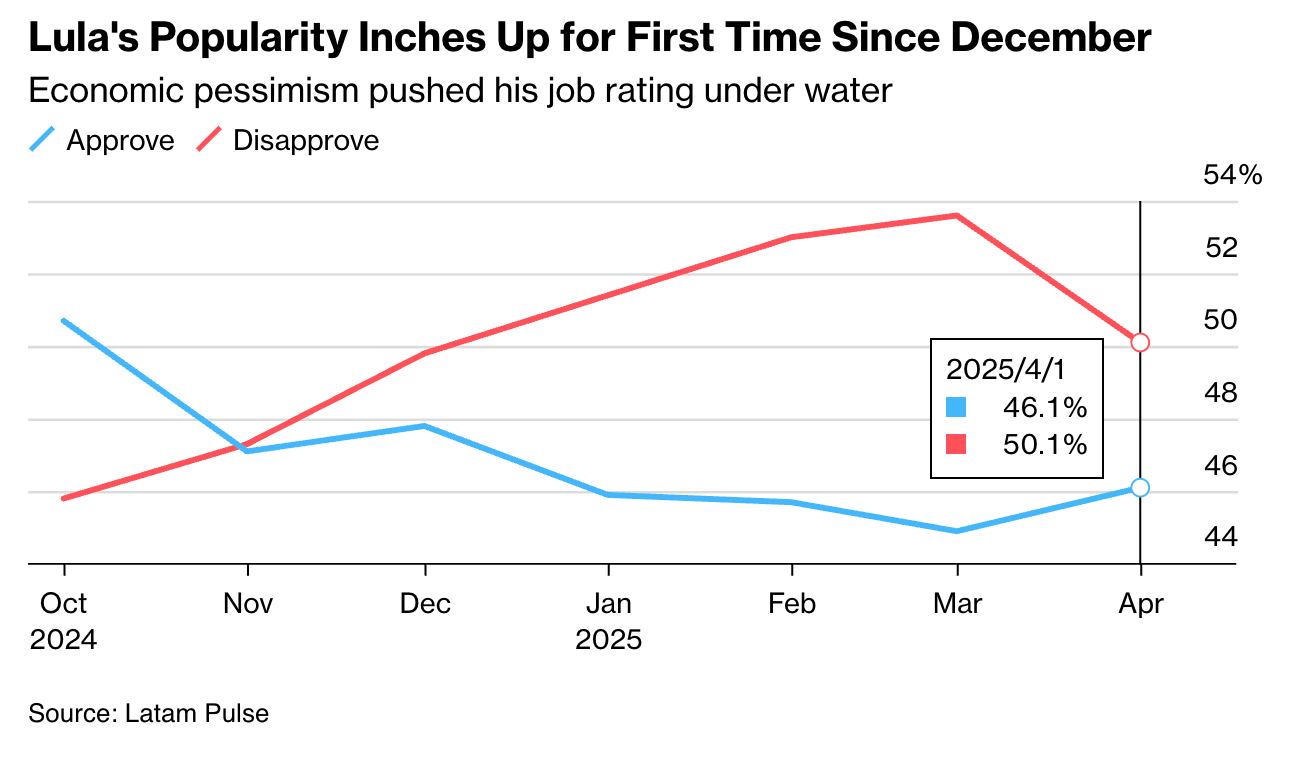

Political risks are far from dead. For 79-year-old President Luiz Inácio Lula da Silva, the test ahead is brutal: a looming election season, softening polls, and sticky inflation all lining up against him. But signs are emerging that the tide may be starting to turn. Food inflation punched +8% YoY in 2024, hammering low-income households—traditionally Lula’s base. Violent crime surged, petty theft became a front-page issue, and Lula’s approval rating in key regions like the Northeast cratered from 26% to 46% negative. Yet cracks don’t equal collapse. Recent data shows Lula’s approval stabilizing, ticking up to 46.1% in April from 44.9% in March, helped by a modest economic rebound and a planned tax cut aimed at low earners.

Fiscal slippage is the wildcard. Lula’s administration is flirting with looser spending caps, and while Congress has thrown some roadblocks, markets are watching closely. For now, BCB’s hawkish stance is keeping things anchored. But if fiscal discipline breaks, BRL’s cushion could evaporate fast.

Compared to Mexico, Brazil’s path looks chaotic but calculated. Banxico is cutting hard. BCB is hiking hard. Real yields are climbing again, BRL is dirt cheap, and the macro anchors—monetary policy independence, external surpluses, relatively stable political transition—are surprisingly intact.

At ~5.6 per USD, BRL has already priced in a world of bad news. Rate spreads are blowing out. Inflation is stubborn but manageable. And crucially, BCB’s independence is still standing. If you're hunting real yield without stepping into a landmine, this setup deserves serious attention.

MXN: Cracks in the Super Peso

MXN was the undisputed heavyweight champ of EM FX. It ripped nearly 20% against the dollar during the Fed’s hiking binge. Rate differentials? Check. Nearshoring buzz? Check. Flows pouring in? Check. But cracks are showing. Banxico, after peaking at 11.25% in early 2023, is now chopping fast—down to 9% by March 2025, with more cuts likely in the pipe. As rates bleed lower, MXN’s once-dominant carry advantage is starting to wobble.

The remittance story is another red flag. With the U.S. immigration crackdown heating up, Mexico’s biggest FX lifeline, remittance flows, is under threat. If that dries up, MXN will lose a major support pillar. Add in crowded positioning, and it’s clear the easy money has already been made. (Soft data coming next week could snap the last nerves.) Translation: MXN is no longer the no-brainer it once was. Meanwhile, Brazil’s steadier rates and rising real yields are starting to steal the spotlight.

Brazil’s Carry: One of the Last Games in Town

The fundamental setup remains in the textbook. Borrow in USD (or JPY if you want to juice it more) and go long BRL through high-yielding locals or FX forwards. Standard playbooks use short-dated futures with tight leverage controls—hedging spot swings while keeping the fat carry intact.

The math is compelling. With Brazil’s policy rate still above 13% and inflation around 5%, the real yield sits above 7%—a spread that's getting harder to find anywhere. Given these numbers, the breakeven for this trade sits around USD/BRL 6.54 (5.45 × 1.2), meaning the real would have to depreciate by more than 20% in a year to wipe out the carry gains.

Even if BRL weakens toward 6.20 per USD—the all-time low it flirted with recently—the trade still holds up, thanks to the juicy rate differential. The real “uh-oh” moment only kicks in if BRL smashes through that floor again, signaling deeper and more structural cracks.

The large interest rate buffer and relatively stable macro backdrop give this trade strong padding. But as always, Argentina’s cautionary tale looms large—fiscal discipline in EM is a box that needs a second and third glance. Global risk-off could also hit BRL in a hurry, and if inflation re-accelerates, it could squeeze returns faster than expected. BCB could cave and push rates back down harder than the market is ready for if the economy starts to deteriorate. Traders leaning into BRL carry need to stay nimble—hedge smart, layer short-dated locals, run tight stops, and clip gains when spreads look too good to ignore. In a world where clean carry trades are disappearing fast, Brazil’s setup still has real legs—it's not risk-free, but it’s one of the few real games left in town.

Harlan Chen (CC ‘27) covers Latin America for the Columbia Emerging Markets Society and is a writer for the Emerging Markets Review. He studies Applied Mathematics with a focus on macro policy and fixed income strategies across East Asia and Latin America.

Jonathan Pollak (CC ‘27) is a managing editor at CEMR studying financial economics and political science. His interests include institutional stability and economic development in Latin America.